Introduction

The CFDI (Comprobante Fiscal Digital por Internet) is the standardized electronic invoicing format in Mexico, managed by the country’s tax authority, the SAT (Servicio de Administración Tributaria). This system ensures that all fiscal documents are digitally generated, validated, and reported to SAT in compliance with national tax laws. In this guide we’ll walk you through the steps required to first register a supplier and then issue invoices in their name.Prerequisites

To issue invoices in Mexico via the SAT, you will need:- Supplier Information:

- Name

- Taxpayer ID (RFC - Registro Federal de Contribuyentes)

- Address

- Fiscal regime code (as defined by SAT)

- Customer Information (same as supplier, plus):

- CFDI use code (Código de uso CFDI)

- Line items:

- Quantity, unit price, and applicable tax rates

- SAT product/service code (Clave Producto-Servicio)

- Additional requirements

- Selected invoice series

- Place of issue code (Lugar de expedición)

- Two certificates required by the SAT:

- e.firma (FIEL): Confirms your identity before SAT. Required to obtain the CSD below and to authorize the PAC to issue on your behalf as explained in step 3 of the Register a Supplier section below.

- CSD (Certificado de Sello Digital): Required to sign electronic invoices and prove they were issued by you.

Setup

Configure your Invopop workspace for CFDI invoicing by following these steps in the Invopop Console:These instructions apply to both the sandbox and live environments, with a few exceptions related to supplier data and registration details when real information is not available.

Set up the Supplier Post-Registration Workflow

Set up the Supplier Registration Workflow

- Template

- Code

- Build from scratch

Connect the SAT Mexico App

In the left sidebar, under the Configuration section, click Apps. This will display all available apps.Search for SAT Mexico and click Connect. The app will move to the “Enabled Apps” section.Next, click Configure. This will open a dialog on the right with two fields:

- Environment: Sandbox / Live

- Post-registration workflow: SAT supplier post-registration

Set up the SAT Issue Invoice Workflow

- Template

- Code

- Build from scratch

Running

Learn how to register a business entity (supplier) and issue CFDI invoices:Register a Supplier

Registering a business entity requires uploading the CSD to our local provider, SW Sapiens, via a form (see Step 2: Complete Supplier Registration). This upload goes to either the sandbox or live environment, depending on your SAT Mexico App configuration. Each CSD is tied to an RFC. When you submit an e-invoice, including the supplier’s RFC, SW Sapiens checks for a valid CSD linked to it, as SAT requires a valid certificate to issue invoices.To speed things up, we’ve pre-registered all the test CSDs listed on the SW Sapien test page in the sandbox.If you’re working in sandbox, you can either:

- Skip this section and go straight to Send an Invoice using a test RFC, or

- Register your own certificate by following the steps below.

Run the Supplier Registration Workflow

In the left sidebar, go to the Parties section and click Suppliers.Then click +New Supplier and enter the supplier’s data manually using the console, or switch to developer mode (Click Build, make sure there are no errors, then click Save.Next, click Select Workflow and execute the Supplier Registration Workflow.

</> icon) to paste the data directly.Here is an example supplier for reference:SAT Mexico supplier example

Complete Supplier Registration

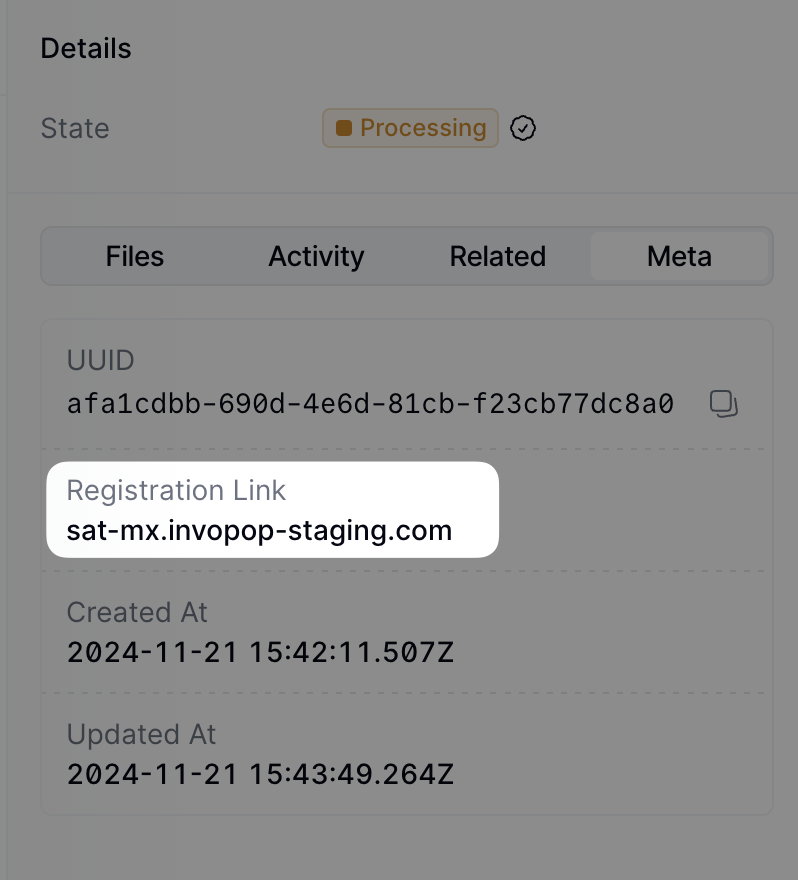

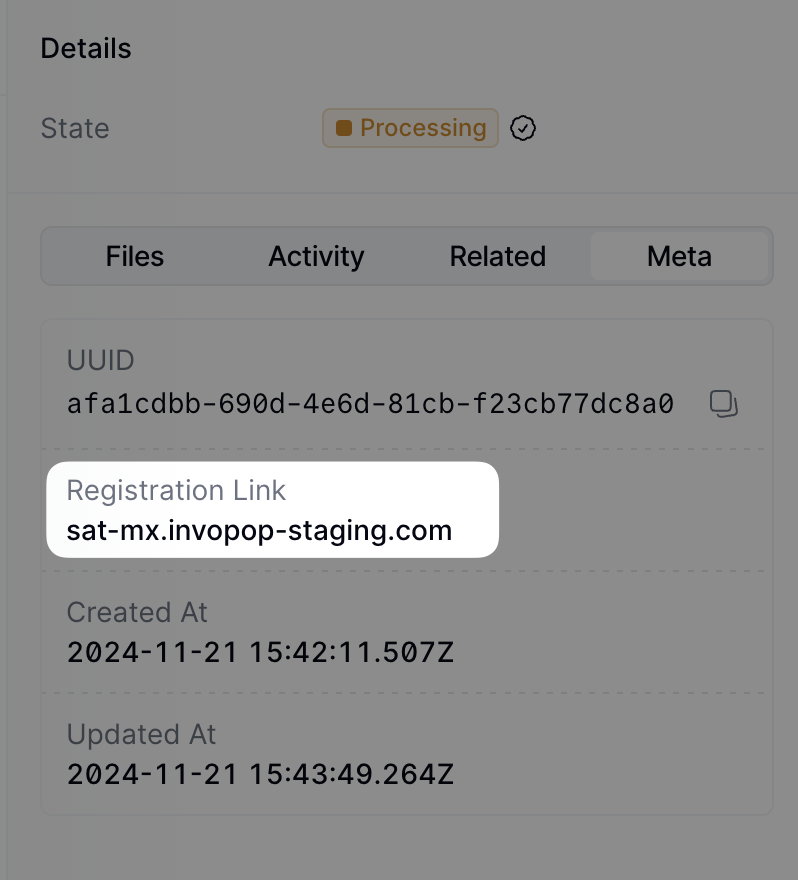

After it completes, open the Details window and click on Meta. You should see a section called Registration Link with a URL:

You can access the registration link via the API by fetching the silo entry and locating the meta entry where the key is

registration-link.Note that this form can be shared directly with the supplier if required.

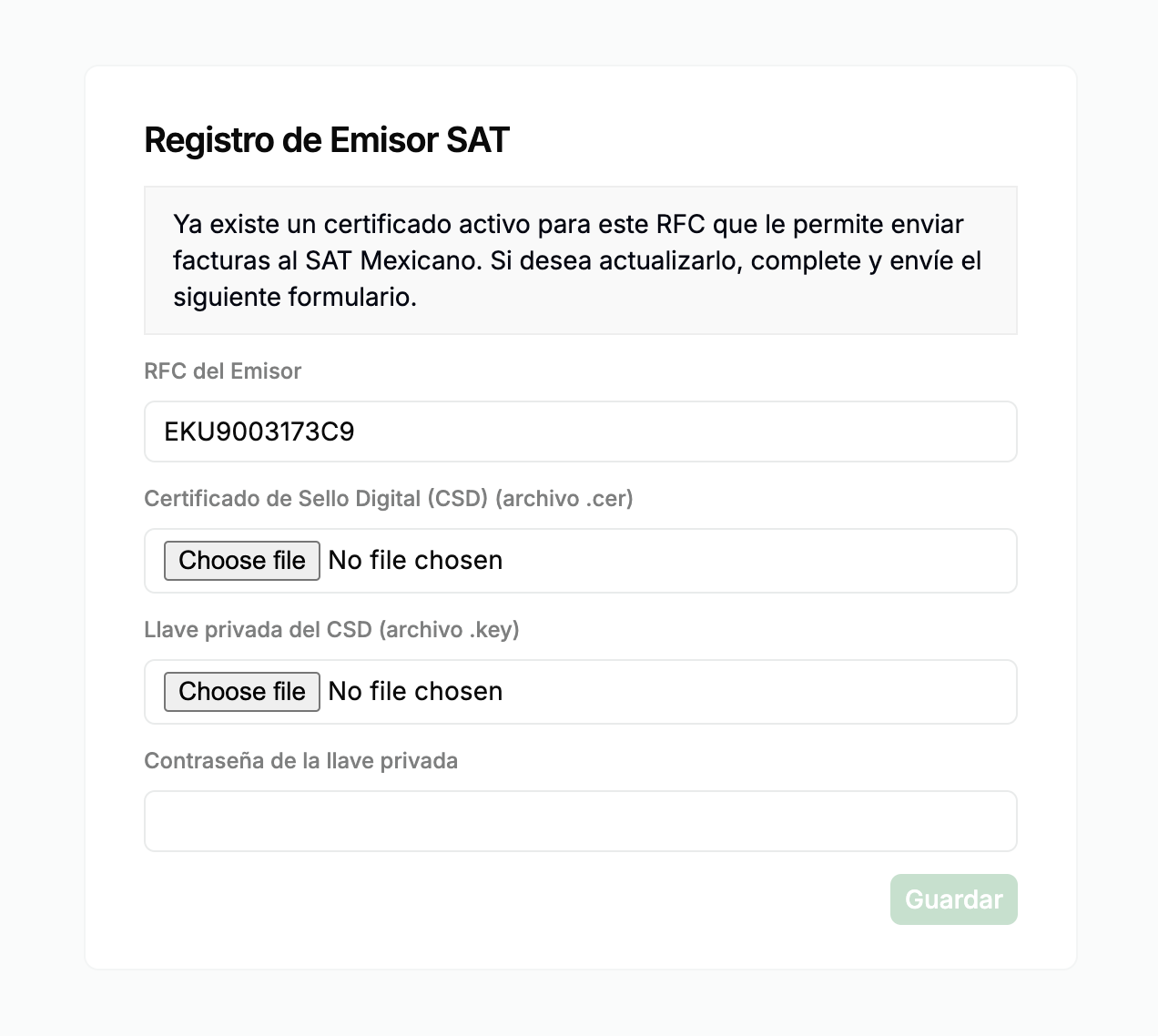

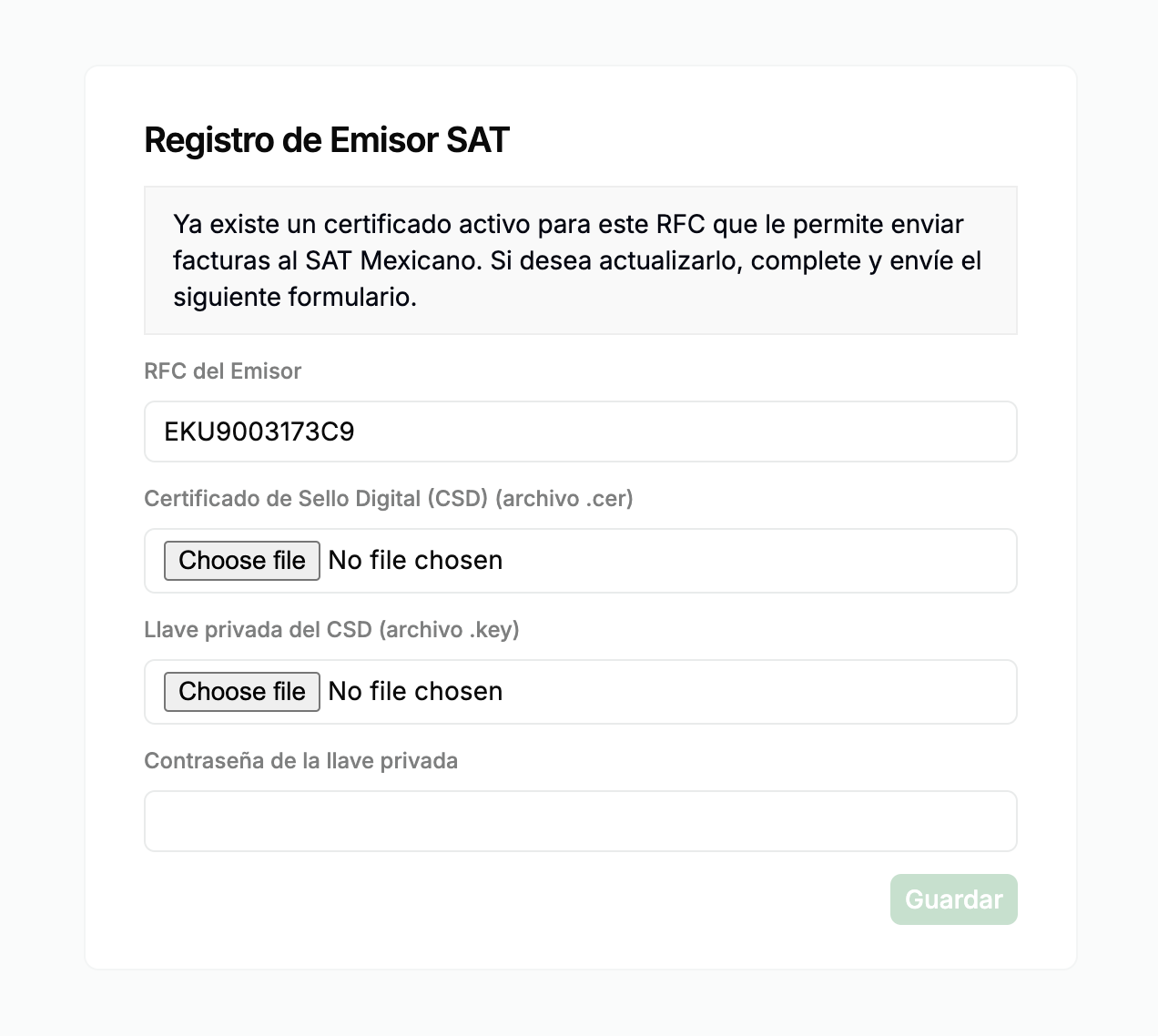

.crt), private key (.key), and the private key password.Follow this guide to generate the CSD certificate and key.When you click Save, the form details are securely sent to the PAC (Proveedor Autorizado de Certificación), who will handle invoice signing and submission to the SAT.You can fill the form via API by sending a PUT request to the registration link. The payload should be a JSON object with the following fields:

csd_file(string): The CSD certificate file (.crt).key_file(string): The private key (.key).password(string): The private key password.

rfc(string): The RFC of the supplier.active_cert(boolean): Whether the certificate is active.

Authorize PAC to Issue Invoices

Since we are using a local PAC, you must authorize the PAC to sign, stamp, and send CFDIs to the SAT on your behalf.To do this, visit the following page and sign the manifesto using your e.firma (FIEL).

Send an Invoice

The following examples are of partial GOBL documents you can copy and paste directly into the Invopop Console or store via the API as silo entries. GOBL Invoices sent to the SAT require the following properties in order to perform the correct normalization and validation steps. Invopop will try to assign these automatically, but we recommend defining them explicitly before upload:$regimeto be set toMX$addonsto includemx-cfdi-v4

B2B Invoice (Personas Morales)

B2B Invoice (Personas Morales)

This main type of invoice is a standard B2B invoice from a Mexican supplier to another Mexican customer.Notice:

- we’ve added the

mx-cfdi-v4addon, this ensures the document will be validated using the CFDI v4 rules built into the GOBL library, - extensions (

ext) fields have been used in multiple locations for fields whose values cannot be determined any other way, - VAT will be applied at the standard rate, the percentage will be set automatically, and,

- there are no totals nor calculations, all of these will be made automatically when uploading.

B2C Invoice (Personas Físicas)

B2C Invoice (Personas Físicas)

This is a standard B2C invoice from a Mexican supplier to a Mexican physical person with tax details, but no specific tax declaration requirements. This would be for a larger sale when the “Simplified” and “Global Invoice” do not apply.In addition to the observations for regular B2B invoices, note in the customer:

- the presence of an RFC in the same format as for companies, and,

- the

mx-cfdi-fiscal-regimeandmx-cfdi-useextensions have been set to616andS01respectively reflecting that the customer is not subject to tax.

Simplified Invoice (Factura al público en general)

Simplified Invoice (Factura al público en general)

In Mexico, a General Public Invoice (Factura al Público en General) is a type of tax document issued to record sales made to customers who do not request an invoice with a specific Federal Taxpayer Registry (RFC) number. Instead, a generic RFC is used to identify the recipient:

- XAXX010101000 for domestic transactions

- XEXX010101000 for foreign transactions

- the

customerfield is not required - the

$tagsfield is used to identify this as a simplified invoice.

Global Invoice

Global Invoice

The Global Invoice is used to group a set of invoices into a single CFDI document.Notice:

- the

$tagsfield has been used to identify this as a global invoice, - each

linehas arefwhich is used to identify the invoice that it belongs to, - the

tax.ext.mx-cfdi-global-month,mx-cfdi-global-period, andmx-cfdi-global-yearfields have been used to identify the global invoice period.

Credit Note

Credit Note

The Credit Note is used to cancel an invoice.Notice:

- the

$typefield has been set tocredit-note, - the

precedingfield has been used to identify the invoice that is being cancelled.

🇲🇽 Invopop resources for Mexico

🇲🇽 Invopop resources for Mexico

| Compliance |  Invoicing compliance in Mexico Invoicing compliance in MexicoCompliance timeline |

| Apps | |

| Guides | SAT Mexico Guide |

| FAQ | Mexico FAQ |

| GOBL | |

| GitHub | gobl.cfdi |

Mexico FAQ

Find answers to frequently asked questions about invoicing in Mexico →

Participate in our community

Ask and answer questions about invoicing in Mexico →